June 27, 2022

How to Stay Safe in a High-Risk Market

The value of the nation's housing markets has been overpriced in many markets for the past couple of years, with the danger of price drops on the horizon. Many buyers are feeling this pressure as they search for their first home as well as investors looking for their first deal or adding to their portfolio. How do you stay safe in a market with a looming cloud of price drops overhead?

Housing Markets

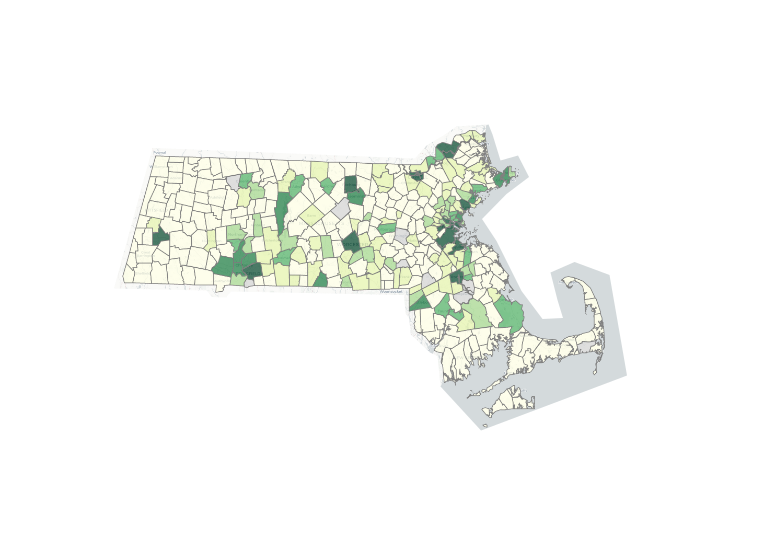

Across 392 housing markets CoreLogic, presented by Fortune, has analyzed the likelihood of these markets seeing a price decline over the next year. Using various factors such as income growth projections, debt-to-income ratios, mortgage rates, etc. they have determined an increased number of markets with a 50% chance of prices declining over those 12 months, this has increased by 73% over the last month.

Similarly, CoreLogic provided analysis across the country indicating overvalued markets based on similar inputs as the previous chart. If you are a buyer in this market for single-family and especially multi-family properties, over the past couple of years many of the purchase prices have not made sense based on cash flow. Even with rising rental markets, these numbers weren't adding up. From my perspective, this will cause a slowdown in the market, but the overall feeling in the local market is that many properties are overvalued, this data from CoreLogic matches this sentiment. For a more in-depth analysis please visit Fortune Article.

How to Stay Safe Buying in a Risky Market

So how do you stay low-risk in a high-risk market? There are a few factors to keep in mind as you are buying:

- Get a local real estate agent to help you understand the market and your real estate deals (depending on your experience as an investor or home buyer).

- Be patient and don't feel pressure to buy, being pressured into a bad deal is far worse than sitting on the sidelines.

- Be honest with yourself concerning your financial situation. Do not overleverage what you are not able or willing to risk.

How to Stay Safe Owning in a Risky Market

During risky market climates, the name of the game is to make sure you will keep all of your investments and assets without losing your shirt.

- Do not overleverage your assets! Limit how much you extend yourself with high-interest loans, credit, or overuse of home equity lines of credit (HELOCs).

- Thin the Heard! Consider selling assets that are not profitable or are sapping the income/profit from your other assets or investments.

- Build your reserves! Take the cash flow from your investments and make sure to save a comfortable amount to account for a rainy day.

The housing market is uncertain for many right now. It's hard to know what the future holds, especially when it feels like prices could drop at any moment. Follow these tips and do your due diligence.

Comments